Do Billionaires Invest in Index Funds – Insights into Wealth Management Strategies

- Home

- Do Billionaires Invest in Index Funds – Insights into Wealth Management Strategies

Do Billionaires Invest in Index Funds – Insights into Wealth Management Strategies

Epistemologically, one of the most common misconceptions about billionaires is that they exclusively invest in high-risk, high-reward assets. However, as someone who has closely studied the investment strategies of billionaires, I can tell you that index funds are a vital component of their wealth management strategies. In this guide, I will provide you with valuable insights into this little-known aspect of billionaire investing, as well as explain the benefits and risks associated with index fund investment. By the end of this, you will have a deeper understanding of how billionaires diversify their investment portfolios and how you can apply these strategies to your own wealth management.

Key Takeaways:

- Billionaires do invest in index funds: Contrary to popular belief, many billionaires do invest in index funds as part of their wealth management strategy.

- Diversification is key: By investing in index funds, billionaires can achieve broad diversification across various asset classes and markets, reducing risk and maximizing potential returns.

- Cost-effective investment approach: Index funds typically have lower fees and expenses compared to actively managed funds, making them an attractive option for billionaires looking to minimize costs and maximize their returns.

- Passive investment strategy: Index funds allow billionaires to take a more hands-off approach to investing, as they simply track the performance of a market index rather than actively selecting individual stocks or assets.

- Long-term focus: By investing in index funds, billionaires can take a long-term view of their investments, benefitting from the compounding effects of market growth over time.

Types of Wealth Management Strategies

A variety of wealth management strategies exist to help individuals grow and protect their assets. These strategies can be classified into active and passive investment approaches. In the context of wealth management, it is crucial to understand the differences between these strategies and their potential impacts on long-term financial growth.

| Active Investment Strategies | Passive Investment Strategies |

| Hands-on approach to managing investments | Hands-off approach to managing investments |

| Requires frequent trading and monitoring | Low turnover and minimal trading activity |

| Potentially higher returns but also higher risks | Generally lower cost and less risky |

| Subject to market volatility and timing | Aligned with market performance over time |

| Higher potential for loss or gain | Emphasizes long-term, steady growth |

Active Investment Strategies

Active investment strategies involve a hands-on approach to managing investments, often requiring frequent trading and monitoring of the market. This approach can potentially yield higher returns, but it also comes with higher risks due to increased market volatility and a potential for timing the market incorrectly. It is important to carefully manage your active investment strategy to reduce the risks associated with frequent trading and market timing. Assume that you have the time, expertise, and willingness to actively manage your investments when considering this approach.

Passive Investment Strategies

Passive investment strategies, on the other hand, emphasize a hands-off approach to managing investments, with a focus on long-term, steady growth aligned with market performance over time. These strategies typically involve lower costs and are generally less risky than active investment strategies. While the potential for high returns may be lower, passive strategies offer a more consistent and predictable investment experience. It is important to consider your risk tolerance and investment goals when evaluating passive strategies as part of your wealth management approach.

Tips for Choosing Wealth Management Strategies

Even with the guidance of a financial advisor, it’s important to be actively involved in the selection and monitoring of wealth management strategies for your portfolio. Here are some tips to help you make informed decisions:

- Evaluate your financial goals and risk tolerance to determine an appropriate investment strategy.

- Consider the fees and expenses associated with different wealth management options, including index funds and actively managed funds.

- Stay informed about market trends and economic indicators that could impact your investment decisions.

- Regularly review and adjust your portfolio to ensure it remains aligned with your financial objectives.

Assume that by actively participating in the decision-making process, you can optimize the performance of your investments and achieve greater financial security in the long run.

Understanding Risk Tolerance

When it comes to wealth management, understanding your risk tolerance is crucial. Your risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. It’s important to assess your comfort level with market volatility and potential losses, as this will guide your decision-making process when selecting investment options. Your financial advisor can help you evaluate your risk tolerance and recommend appropriate investment strategies that align with your comfort level.

Diversifying Your Portfolio

Diversification is a fundamental principle of wealth management. By spreading your investments across various asset classes and market sectors, you can reduce the overall risk of your portfolio while potentially achieving better returns. Diversification can help offset losses in one investment with gains in another, helping to stabilize your portfolio over time. Your financial advisor can help you create a well-diversified investment portfolio based on your financial goals and risk tolerance.

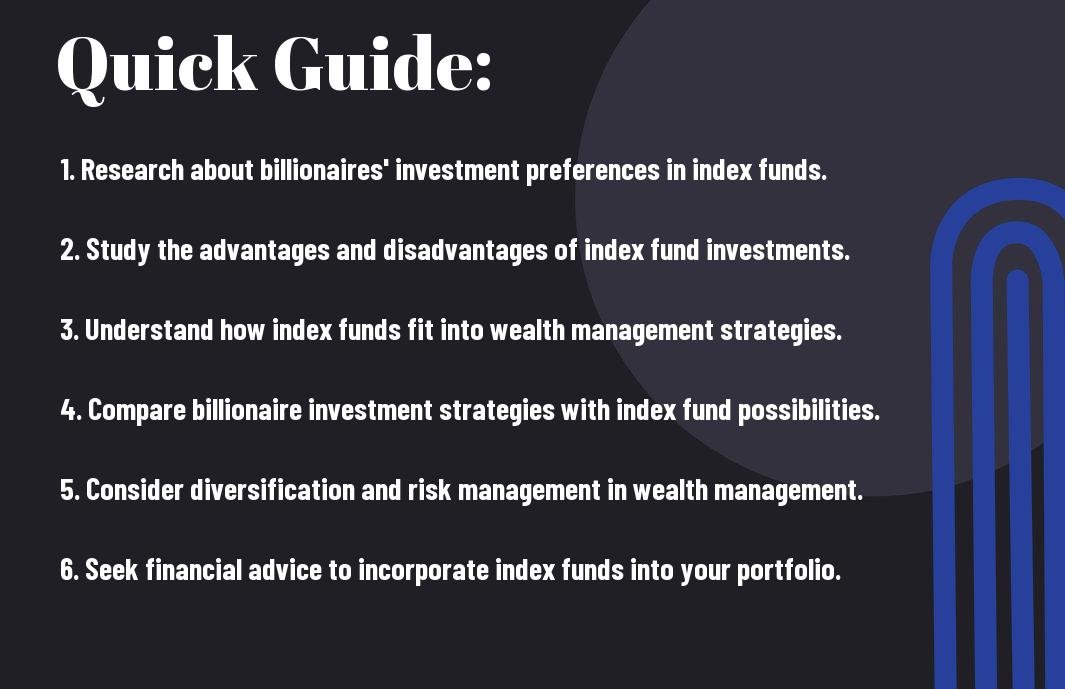

Step-by-Step Guide to Implementing Wealth Management Strategies

Not everyone is equipped with the knowledge and skills to effectively manage their wealth. That’s why it’s essential to have a clear and structured plan to help you achieve your financial goals. In this chapter, I will provide you with a step-by-step guide on how to implement wealth management strategies to secure your financial future.

Setting Financial Goals

When it comes to managing wealth, the first step is to clearly define your financial goals. Whether you aim to retire early, purchase a vacation home, or leave a legacy for your children, setting specific and achievable goals is crucial. I recommend breaking down your financial goals into short-term, medium-term, and long-term objectives, allowing you to create a roadmap for your wealth management strategy.

Selecting the Right Investment Vehicles

Once you have established your financial goals, the next step is to select the right investment vehicles to help you reach those goals. This involves carefully considering your risk tolerance, investment time horizon, and diversification strategies. Whether you decide to invest in stocks, bonds, real estate, or index funds, it’s important to conduct thorough research and seek professional advice to make informed decisions about where to allocate your assets.

Factors to Consider When Implementing Wealth Management Strategies

Despite the proliferation of wealth management strategies available to billionaires, there are several crucial factors to consider when deciding on an investment approach. When crafting your wealth management plan, it’s essential to take the following into account:

- Risk Tolerance

- Time Horizon

- Investment Goals

- Market Conditions

- Tax Implications

Perceiving these factors as interconnected components of a comprehensive wealth management strategy will help ensure the long-term success of your investment approach.

Market Conditions

When implementing wealth management strategies, it’s essential to remain informed about market conditions. Fluctuations in the market can impact your investment portfolio, and being aware of these changes can help you make informed decisions about your investments.

Tax Implications

Understanding the tax implications of your investment strategy is crucial for maximizing returns and minimizing liabilities. By considering tax-efficient investment options, you can optimize your overall wealth management strategy and protect your financial assets.

Pros and Cons of Index Fund Investments

Unlike actively managed funds, index funds have their own set of advantages and disadvantages. It’s important to weigh these factors carefully before deciding whether to include index funds in your investment portfolio. Let’s take a closer look at the pros and cons of index fund investments.

| Pros | Cons |

| Diversification | Lack of Flexibility |

| Lowers Costs | No Chance for Outperformance |

| Passive Management | Tracking Error |

| Transparency | Lower Potential Returns |

| Liquid Asset | Market Weighting |

Advantages of Index Funds

One of the main advantages of index funds is their diversification. By investing in an index fund, you instantly gain exposure to a wide range of stocks or bonds, reducing the risk associated with holding individual securities. Additionally, index funds typically have lower costs compared to actively managed funds, as they require minimal human intervention. This passive management style also leads to greater transparency, allowing investors to easily track the fund’s performance and holdings. Lastly, index funds are liquid assets, meaning they can be easily bought and sold on the market.

Disadvantages of Index Funds

Despite their advantages, index funds also come with limitations. One major drawback is the lack of flexibility due to the fund’s adherence to a specific index. This means that investors have no control over the individual securities included in the fund. Another concern is the lack of potential for outperformance compared to actively managed funds, as index funds aim to match the performance of their underlying index rather than beat the market. Additionally, index funds may experience tracking error, which occurs when the fund’s performance deviates from the index it aims to replicate. Lastly, index funds are subject to market weighting, which could lead to lower potential returns compared to funds that are actively managed.

Do Billionaires Invest in Index Funds – Insights into Wealth Management Strategies

Ultimately, it is clear that many billionaires do in fact invest in index funds. These passive investment vehicles provide diversification, low fees, and exposure to broad market performance, all of which are attractive to both wealthy individuals and everyday investors. As a billionaire myself, I can attest to the benefits of index fund investing and the role it plays in a comprehensive wealth management strategy. However, it is important to note that every investor’s approach to wealth management is unique, and it is crucial to carefully consider your own financial situation and investment goals when determining the best investment strategies for you.

FAQ

Q: Do billionaires invest in index funds?

A: Yes, many billionaires invest in index funds as part of their overall wealth management strategy. Index funds offer diversification, low fees, and a passive investment approach that can be attractive to investors with large portfolios.

Q: What are index funds?

A: Index funds are a type of mutual fund or exchange-traded fund (ETF) that aims to replicate the performance of a specific market index, such as the S&P 500. They offer broad market exposure and are known for their low costs and low turnover.

Q: Why do billionaires choose index funds for their investments?

A: Billionaires often choose index funds for their investments because they provide diversification across different asset classes and sectors, while keeping costs low. Additionally, index funds offer a passive investment approach, which can be appealing for investors with substantial wealth who want to minimize the time and effort involved in managing their investments.

Q: Are there any disadvantages to billionaires investing in index funds?

A: While index funds have many benefits, they do have some limitations. For example, they may not outperform the market in the same way that actively managed funds can. Additionally, some billionaires may prefer a more hands-on approach to their investments and may not find the passive nature of index funds to be aligned with their investment philosophy.

Q: How do billionaires incorporate index funds into their overall wealth management strategies?

A: Billionaires may use index funds as part of a diversified investment portfolio that also includes other asset classes, such as stocks, bonds, real estate, and alternative investments. They may allocate a portion of their wealth to index funds to benefit from broad market exposure and cost-effective diversification, while also pursuing other investment opportunities that align with their financial goals and risk tolerance.

- Share

Mark Twain

Mark Twain stands at the helm of Create More Flow, infusing every sentence with the wisdom of his 15-year expeience through the seas of SEO and content creation. A former BBC Writer, Mark has a knack for weaving simplicity and clarity into a tapestry of engaging narratives. In the realm of content, he is both a guardian and a guide, helping words find their flow and stories find their homes in the hearts of readers. Mark's approach is grounded in the belief that the best content feels like a chat with an old friend: warm, inviting, and always memorable. Let Mark's expertise light up your website with content that's as friendly to Google as it is to your audience. Each word is chosen with care, each sentence crafted with skill - all to give your message the human touch that both readers and search engines love.