How Much Is Property Tax in Calgary? How to Calculate and Pay Your Property Tax

- Home

- How Much Is Property Tax in Calgary? How to Calculate and Pay Your Property Tax

How Much Is Property Tax in Calgary? How to Calculate and Pay Your Property Tax

Intriguingly, many homeowners in Calgary often find themselves unsure about how their property taxes are calculated and what they need to do to pay them. However, understanding the ins and outs of property tax is crucial in order to avoid any potential penalties or surprises. Today, I will guide you through the process of calculating and paying your property tax in Calgary, providing important information about the tax rates, assessment values, and due dates. By the end of this post, you will have a clear understanding of how much you can expect to pay and the steps you need to take in order to ensure that your property tax is paid on time and in full. Let’s dive in and demystify the world of property tax in Calgary!

Key Takeaways:

- Property tax rates in Calgary are determined by the city council and are based on the budget requirements for municipal services and infrastructure.

- Property tax can be calculated using the assessed value of the property and the current tax rate, which is typically expressed as a percentage.

- Property tax can be paid in installments or as a lump sum, with deadlines set by the city for payment.

- Calgary offers various payment options for property tax, including online payment, pre-authorized payments, and in-person payments at designated locations.

- Understanding your property tax assessment and learning about available tax exemptions can help you manage and potentially reduce your property tax obligations.

Types of Property Tax in Calgary

To understand the property tax system in Calgary, it’s important to first recognize that there are two main types of property tax that homeowners need to be aware of. These are municipal property tax and provincial property tax. Let’s break down each one and see how they factor into your overall property tax bill.

| Types of Property Tax | Description |

|---|---|

| Municipal Property Tax | This tax is collected by the City of Calgary and is used to fund city services and infrastructure. |

| Provincial Property Tax | Collected by the province of Alberta, this tax contributes to funding for education and other provincial services. |

Municipal Property Tax

The municipal property tax in Calgary is the main source of revenue for the city and is used to fund essential services such as police and fire protection, road maintenance, transit, and parks and recreation. The amount of tax you owe is calculated based on the assessed value of your property as determined by the City Assessor’s office. It’s important to note that property tax rates can vary depending on the area of the city your property is located in.

Provincial Property Tax

When it comes to provincial property tax, the province of Alberta collects this tax to fund services such as education, health care, and social programs. The amount you owe is calculated based on the assessed value of your property in combination with the provincial tax rate. It’s worth noting that the provincial government sets the tax rates, and they can vary from year to year.

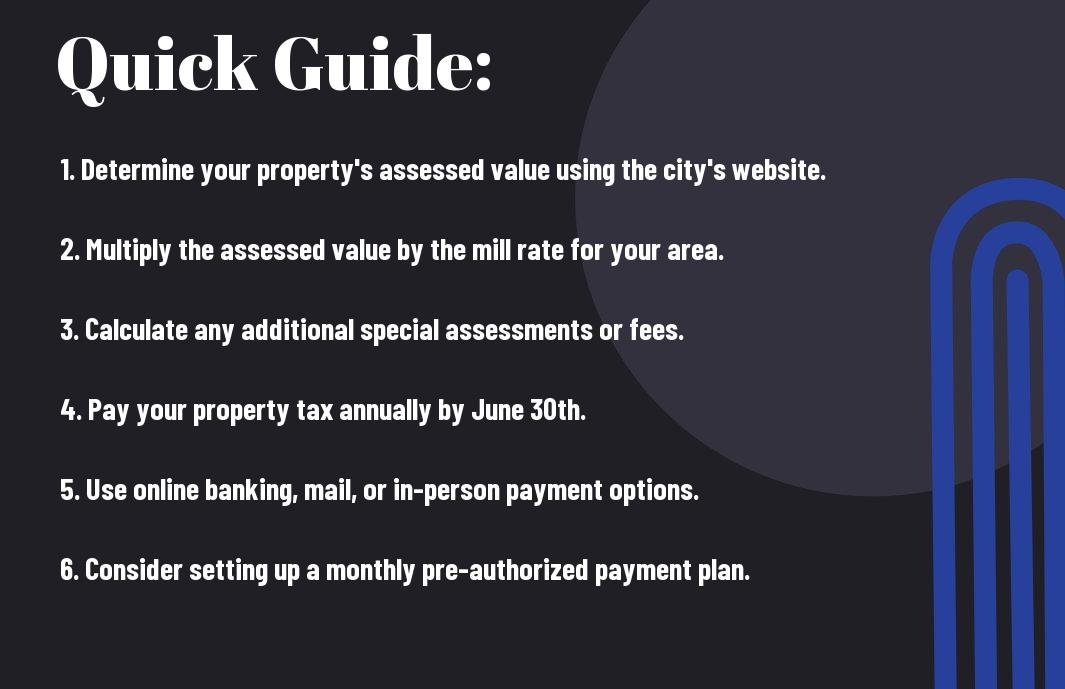

Tips for Calculating and Paying Your Property Tax

The first step in calculating your property tax bill is to understand the assessment value of your property. This is the value that is used to determine how much tax you owe. You can find this information on your annual Property Assessment Notice that is sent out by the City of Calgary. Once you have this value, you can use the mill rate for the year to calculate how much you owe. The mill rate is the amount of tax payable for each dollar of the assessed value of the property.

- Ensure you have the correct assessment value

- Look up the mill rate for the year

- Calculate the tax amount

- Consider any tax credits or exemptions you may be eligible for

This process can be complex, so it’s important to double-check your calculations and reach out to the City of Calgary or a tax professional if you need assistance. Property taxes are typically due at the end of June, and it’s essential to ensure that you submit your payment on time to avoid late fees.

Keeping Up with Deadlines

One critical aspect of paying your property tax is making sure that you meet all of the necessary deadlines. The deadline for paying your property tax in Calgary is typically at the end of June each year. Missing this deadline can result in substantial penalties and interest added to your bill, so it’s vital to mark this date on your calendar and make sure you submit your payment on time. I advise setting a reminder a few weeks before the deadline to give yourself plenty of time to gather the necessary funds and make the payment.

Utilizing Online Resources

The City of Calgary provides a range of online resources to help you calculate and pay your property tax. The city’s website offers a property tax calculator that can help you estimate the amount you owe, as well as detailed information on how to make your payment. Additionally, you can sign up for online billing to receive your tax notices electronically, making it easier to keep track of important deadlines. I highly recommend taking advantage of these resources to ensure that you stay on top of your property tax obligations.

Step-by-Step Guide to Calculating and Paying Your Property Tax

For most homeowners in Calgary, property tax is a significant annual expense that requires careful planning and budgeting. Fortunately, calculating and paying your property tax doesn’t have to be a complex or daunting task. Below, I will provide you with a step-by-step guide to help you navigate this process with ease.

Understanding Assessment Value

When it comes to calculating your property tax, the first step is to understand the assessment value of your property. The assessment value is the estimated market value of your property as determined by the City Assessor. This value plays a crucial role in determining the amount of property tax you will owe. Keep in mind that the assessment value can fluctuate from year to year based on various factors such as market conditions and property renovations.

Calculating Property Tax Amount

Once you have a clear understanding of your property’s assessment value, you can proceed to calculate the actual property tax amount. In Calgary, property tax is calculated by multiplying the assessed value of your property by the tax rate set by the city. The tax rate is expressed as a percentage and may vary depending on the property type and location. It’s important to note that the tax rate is not set by individual homeowners, but rather by the city council or municipal government.

Factors Affecting Property Tax Amount

Now, let’s talk about the factors that can affect the amount of property tax you pay in Calgary. It’s important to understand these factors so that you can calculate and plan for your property tax payments. Recognizing these factors will help you make informed decisions about your property.

- Property Location: The location of your property within Calgary can have a significant impact on your property tax amount. Different neighborhoods have different tax rates, and properties that are located in areas with more amenities and services often have higher property tax rates.

- Property Assessment: The assessed value of your property is a key factor in determining your property tax amount. The City of Calgary conducts property assessments annually to determine the market value of properties, which is used to calculate property taxes.

Property Location

The location of your property within Calgary can have a significant impact on your property tax amount. Different neighborhoods have different tax rates, and properties that are located in areas with more amenities and services often have higher property tax rates. For example, if your property is located in a neighborhood with good schools, parks, and public transportation, you can expect to pay higher property taxes compared to properties in less developed areas. Factors such as proximity to commercial areas and new developments also play a role in determining property tax rates.

Property Assessment

The assessed value of your property is a key factor in determining your property tax amount. The City of Calgary conducts property assessments annually to determine the market value of properties, which is used to calculate property taxes. The assessment takes into account various factors such as the size of the property, its condition, and comparable property values in the area. It’s important to keep in mind that an increase in the assessed value of your property will result in higher property tax payments. On the other hand, a decrease in the assessed value may result in lower tax payments, offering potential savings for property owners.

Pros and Cons of Property Tax in Calgary

Your property tax in Calgary supports the funding of essential public services and infrastructure. However, there are both positive and negative aspects to consider when it comes to property taxes. Let’s take a look at the pros and cons in the table below:

| Pros | Cons |

| 1. Property taxes fund important public services such as police and fire departments. | 1. Property taxes can be a significant financial burden for property owners, especially for those on fixed incomes. |

| 2. Property taxes contribute to the maintenance and improvement of local infrastructure, such as roads and parks. | 2. Property tax rates can increase, leading to higher tax bills for property owners. |

| 3. Property taxes help support the local education system and other community programs. | 3. Increases in property taxes can affect housing affordability for homeowners. |

| 4. Property taxes are a stable source of revenue for the city, helping to ensure financial stability. | 4. Some property owners may feel that they are not directly benefiting from the services funded by property taxes. |

Funding Public Services

Property taxes play a crucial role in funding public services in Calgary. They support essential services such as police and fire departments, as well as the maintenance of local infrastructure. Without property taxes, the city would struggle to provide the necessary resources for the community. However, it’s important to be mindful of the impact that property taxes can have on property owners, especially when tax rates increase.

Impact on Property Owners

As a property owner in Calgary, it’s essential to understand the impact of property taxes on your financial situation. While property taxes contribute to funding important public services and infrastructure, they can also lead to a significant financial burden, especially when tax rates increase. It’s crucial to stay informed about any potential changes in property tax rates and to plan for any potential impact on your finances.

Summing up: How Much Is Property Tax in Calgary? How to Calculate and Pay Your Property Tax

As I have outlined, property tax in Calgary is calculated based on the assessed value of your property and the current tax rate. By multiplying these two numbers, you can determine how much you owe in property tax. Additionally, I have provided information on the payment options available to you, including the option to pay in installments or through your mortgage lender. It is important to stay informed about property tax rates and changes in legislation to ensure you are paying the correct amount. By understanding how property tax is calculated and the various payment methods available, you can effectively budget and manage your property tax obligations in Calgary.

FAQ

Q: How much is property tax in Calgary?

A: The property tax rate in Calgary varies yearly and is calculated based on the assessed value of your property. The City sets the property tax rate each year during budget deliberations. Once the tax rate is set, it is applied to the assessed value of your property to determine your property tax bill.

Q: How is property tax calculated in Calgary?

A: To calculate your property tax in Calgary, multiply the assessed value of your property by the tax rate set by the City. The assessed value can be found on your property assessment notice, which is sent to you annually. For example, if your property’s assessed value is $500,000 and the tax rate is 0.01, your property tax bill would be $5,000.

Q: When is property tax due in Calgary?

A: Property tax in Calgary is due on June 30th of each year. It is important to pay your property tax on time to avoid any penalties or interest charges.

Q: How can I pay my property tax in Calgary?

A: You can pay your property tax in Calgary through various methods, including online banking, in person at your bank, by mail, or in person at City Hall. The City also offers a pre-authorized payment plan, where your property tax is automatically withdrawn from your bank account on a monthly basis.

Q: What happens if I don’t pay my property tax in Calgary?

A: If you don’t pay your property tax in Calgary by the due date, you will be subject to penalties and interest charges. The penalty for late payment is 7% on July 1st and a further 7% on October 1st. Interest is also charged at a rate of 7% on the unpaid balance on the first day of each month.

- Share

Mark Twain

Mark Twain stands at the helm of Create More Flow, infusing every sentence with the wisdom of his 15-year expeience through the seas of SEO and content creation. A former BBC Writer, Mark has a knack for weaving simplicity and clarity into a tapestry of engaging narratives. In the realm of content, he is both a guardian and a guide, helping words find their flow and stories find their homes in the hearts of readers. Mark's approach is grounded in the belief that the best content feels like a chat with an old friend: warm, inviting, and always memorable. Let Mark's expertise light up your website with content that's as friendly to Google as it is to your audience. Each word is chosen with care, each sentence crafted with skill - all to give your message the human touch that both readers and search engines love.