Is Property Tax Deductible in Canada? The Rules and Exceptions of Claiming Property Tax

- Home

- Is Property Tax Deductible in Canada? The Rules and Exceptions of Claiming Property Tax

Is Property Tax Deductible in Canada? The Rules and Exceptions of Claiming Property Tax

Upon my research and experience, I have found that many homeowners in Canada are confused about whether property tax is deductible or not. I want to clarify this for you once and for all. Property tax is not generally deductible in Canada with a few exceptions. However, there are specific circumstances in which you can claim property tax as a deduction. In this guide, I will walk you through the rules and exceptions of claiming property tax in Canada, so you can make sure you are taking advantage of any deductions available to you. It is important to understand these rules in order to avoid any potential issues with the Canada Revenue Agency and to maximize your tax benefits. So, let’s dive into the details and ensure you are making the most of your property tax deductions.

Key Takeaways:

- Property tax in Canada is not deductible on your personal residence, but it may be deductible if the property is used for business or rental purposes.

- Property tax deductions are subject to specific rules and exceptions, and it’s important to consult with a tax professional to ensure eligibility.

- Homeowners can claim a homeowner’s grant on their property tax, which provides a reduction in property taxes for eligible individuals.

- Property tax deductions for rental properties can include a portion of the property tax paid as a deductible expense against rental income.

- Business owners can deduct property taxes as a business expense if the property is used for business purposes, but there are limitations and specific guidelines to follow for claiming this deduction.

Types of Property Tax in Canada

To understand the rules and exceptions of claiming property tax in Canada, it is important to first familiarize yourself with the different types of property tax that exist in the country. Here are the main types of property tax in Canada:

| Property Tax Type | Description |

|---|---|

| Municipal Property Tax | This is the tax imposed by municipal governments on properties within their jurisdiction. |

| Provincial Property Tax | This is a tax levied by provincial governments on certain types of properties. |

| School Tax | Some provinces and territories impose a separate tax to fund their public school systems. |

| Waterfront Property Tax | Some properties located along waterfronts may be subject to a specific tax. |

| Commercial Property Tax | Business properties are often subject to a different tax rate than residential properties. |

Municipal Property Tax

When it comes to municipal property tax, this is a tax imposed by the municipal government on properties within its jurisdiction. The amount of tax you pay is based on the assessed value of your property and the municipal tax rate. Municipal property taxes are used to fund local services and infrastructure, such as roads, garbage collection, and public parks.

Provincial Property Tax

Provincial property tax is levied by provincial governments on certain types of properties. The rules and rates for provincial property tax can vary significantly from one province to another. Some provinces also levy a separate school tax to fund their public school systems. It is important to be aware of the specific rules and rates in your province when it comes to claiming property tax deductions.

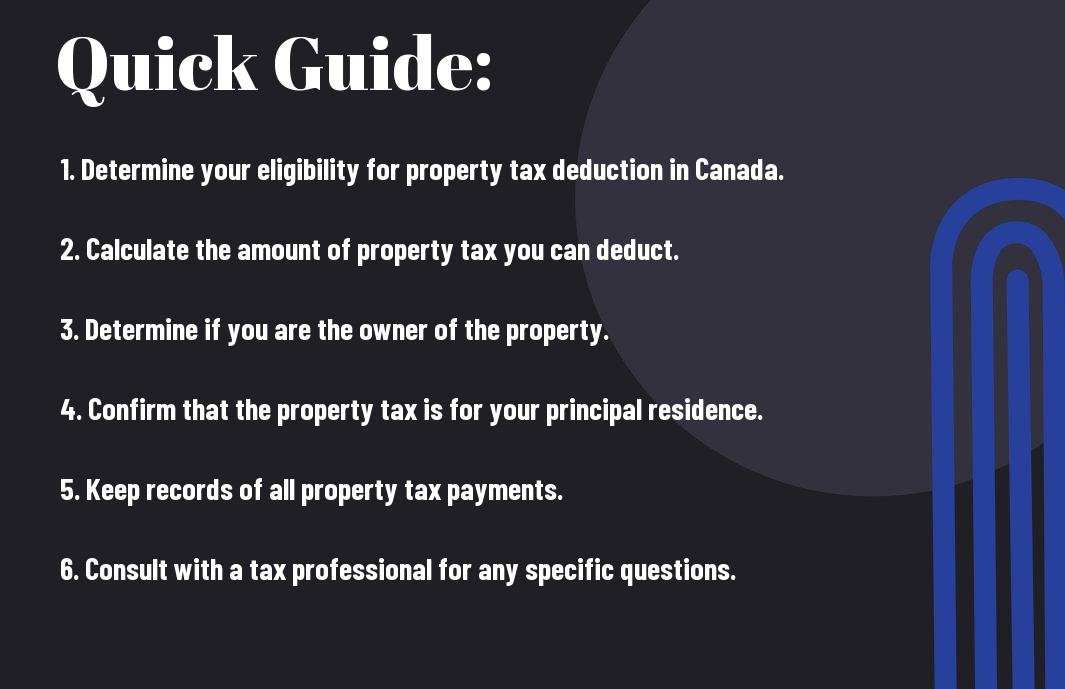

Tips for Claiming Property Tax Deduction

While claiming property tax deduction in Canada, there are some tips that can help you maximize your tax benefits. Here are some important tips for claiming property tax deduction:

- Organize your documents: Keep all your property tax statements and receipts in one place. This will make it easier for you to provide the necessary documentation when filing your tax return.

- Understand the rules: Familiarize yourself with the specific rules and regulations regarding property tax deduction in Canada. This will help you avoid any potential mistakes that could result in a penalty.

- Stay informed about changes: Keep yourself updated with any changes in tax laws and regulations. This will ensure that you are aware of any new eligibility requirements or deductions that may be applicable to you.

Assume that following these tips will make the process of claiming property tax deduction easier and more effective for you.

Keeping Detailed Records

When it comes to claiming property tax deduction in Canada, keeping detailed records is crucial. Make sure to retain all relevant documents, such as property tax statements and receipts, to support your claim. Having organized records will not only make the filing process smoother, but it can also serve as evidence in case of an audit. By keeping detailed records, you are safeguarding yourself and ensuring that you receive the full tax benefit you are entitled to.

Understanding Eligibility Requirements

Before claiming property tax deduction, it’s essential to understand the eligibility requirements. Not all property tax payments are eligible for deduction, and there are specific criteria that must be met. For example, the property must be used for certain purposes, such as residential or commercial use. By understanding eligibility requirements, you can avoid any potential issues with your claim and ensure that you are compliant with the rules and regulations set by the Canada Revenue Agency.

Step-by-Step Guide to Claiming Property Tax Deduction

Keep track of your property tax payments and related documents. This will help you accurately report your property tax deduction on your tax return.

| Step | Action |

|---|---|

| 1 | Gather property tax payment receipts and related documents |

| 2 | Consult with a tax professional or use tax software to ensure claiming the deduction correctly |

| 3 | Report the deductible amount on your tax return in the appropriate section |

Determine Eligibility

Before claiming property tax deduction in Canada, it’s important to determine if you are eligible. You must be the legal owner of the property and the property must be located in Canada. Additionally, the property tax must be imposed by a Canadian taxing authority in order to be deductible.

Calculate the Deductible Amount

To calculate the deductible amount of your property tax, you will need to determine the portion of the tax that relates to the maintenance and services provided by the municipality. This can generally be found on your property tax bill or by contacting your local taxing authority. It’s important to note that only the portion of property tax that relates to municipal services is deductible, while any school or education taxes are not eligible for deduction.

Factors Affecting Property Tax Deductibility

Despite property tax being generally tax-deductible in Canada, there are various factors that can affect its deductibility. These factors determine whether you are eligible to claim property tax as a deduction on your tax return.

- Property Ownership Status

- Primary Residence vs. Investment Property

- Tax Laws and Regulations

- Changes in Government Policies

Perceiving these crucial factors can help you understand the implications they may have on your property tax deductibility and how they impact your overall tax situation.

Property Ownership Status

When it comes to property tax deductibility, your property ownership status plays a crucial role. If you own a property in Canada, whether it’s your primary residence or an investment property, it will have an impact on your eligibility to claim property tax as a deduction on your tax return.

Primary Residence vs. Investment Property

Whether the property in question is your primary residence or an investment property also affects the tax deductibility of property taxes. The rules for claiming property tax deductions differ depending on the type of property you own. It’s important to understand the distinctions between these property types and how they influence the deductibility of property taxes.

Pros and Cons of Claiming Property Tax Deduction

Not everyone is aware of the pros and cons of claiming a property tax deduction in Canada. It’s important to understand the potential benefits and drawbacks before deciding whether or not to claim this deduction on your taxes.

| Pros | Cons |

| 1. Lowering tax liability | 1. Potential reduction in government benefits |

| 2. Financial benefits | 2. Increased possibility of audit |

| 3. Potential tax savings | 3. Limited deduction amount |

| 4. Reduction in overall expenses | 4. Additional paperwork and documentation |

Financial Benefits

Claiming a property tax deduction can result in financial benefits for eligible homeowners. By reducing your taxable income, you may be able to lower your overall tax liability and potentially save money on your annual tax bill. This can provide some relief for homeowners who are struggling to manage their expenses.

Potential Drawbacks

On the other hand, there are potential drawbacks to claiming a property tax deduction. For example, if you are already receiving government benefits based on your income level, claiming this deduction could potentially reduce or eliminate those benefits. Additionally, claiming these deductions might increase your chances of being audited by the Canada Revenue Agency, leading to additional stress and potential penalties if any discrepancies are found.

Conclusion

Upon reflecting on the rules and exceptions of claiming property tax in Canada, it is evident that property tax is generally not deductible for personal residences, but can be claimed for certain types of properties and for business purposes. Understanding the specific rules and exceptions is crucial for maximizing your tax benefits and avoiding unnecessary penalties. By consulting with a tax professional and staying informed about the latest regulations, you can ensure that you are making the most of your property tax deductions while remaining compliant with Canadian tax laws.

FAQ

Q: Is property tax deductible in Canada?

A: Yes, property tax is deductible in Canada. Homeowners can claim a deduction for the property taxes they pay on their primary residence, as well as on any secondary properties they own.

Q: What are the rules for claiming property tax deductions in Canada?

A: In order to claim a property tax deduction in Canada, the property must be owned by the individual claiming the deduction and must be used for personal purposes, such as a primary residence or a vacation home. The property tax must also be paid during the tax year in which the deduction is being claimed.

Q: Are there any exceptions to the property tax deduction in Canada?

A: Yes, there are some exceptions to claiming a property tax deduction in Canada. Properties used for rental or business purposes are not eligible for the deduction. Additionally, any portion of property tax that is designated for local improvements, such as street lighting or sidewalk repairs, is not deductible.

Q: Can property tax deductions be claimed for properties located outside of Canada?

A: No, property tax deductions can only be claimed for properties located within Canada. Properties located outside of Canada are not eligible for the deduction.

Q: How do I claim a property tax deduction on my taxes in Canada?

A: To claim a property tax deduction in Canada, homeowners must include the amount of property tax paid on their annual income tax return. The property tax deduction is claimed as a non-refundable tax credit, which can reduce the amount of federal or provincial tax owed. Homeowners should keep records of their property tax payments to support their deduction claims.

- Share

Mark Twain

Mark Twain stands at the helm of Create More Flow, infusing every sentence with the wisdom of his 15-year expeience through the seas of SEO and content creation. A former BBC Writer, Mark has a knack for weaving simplicity and clarity into a tapestry of engaging narratives. In the realm of content, he is both a guardian and a guide, helping words find their flow and stories find their homes in the hearts of readers. Mark's approach is grounded in the belief that the best content feels like a chat with an old friend: warm, inviting, and always memorable. Let Mark's expertise light up your website with content that's as friendly to Google as it is to your audience. Each word is chosen with care, each sentence crafted with skill - all to give your message the human touch that both readers and search engines love.