Do First Time Home Buyers Pay Land Transfer Tax? How to Qualify for a Rebate or Exemption

- Home

- Do First Time Home Buyers Pay Land Transfer Tax? How to Qualify for a Rebate or Exemption

Do First Time Home Buyers Pay Land Transfer Tax? How to Qualify for a Rebate or Exemption

Rarely do first time home buyers pay land transfer tax, as many jurisdictions offer exemptions or rebates to help alleviate the financial burden of purchasing a home for the first time. However, it is important to understand the specific requirements and qualifications in order to qualify for a rebate or exemption. In this guide, I will walk you through the process of determining whether you are eligible for a tax exemption or rebate when purchasing your first home, as well as the steps you need to take to ensure that you receive the maximum benefit available to you.

Key Takeaways:

- First-time home buyers may be eligible for a land transfer tax exemption or rebate. This can help reduce the financial burden of purchasing a first home.

- Qualifications for the exemption or rebate vary by location. It’s important to research the specific criteria in your area to see if you qualify.

- Some areas offer a full exemption for first-time home buyers. This means they don’t have to pay any land transfer tax at all, while others offer a partial rebate on the tax paid.

- Proof that you are a first-time home buyer is typically required. This can include documents such as a signed agreement of purchase and sale, and a copy of the land transfer tax statement.

- It’s crucial to apply for the rebate or exemption as soon as possible after purchasing a home. Missing the deadline for application can result in missing out on the potential savings.

Types of Land Transfer Taxes

The land transfer tax is a tax imposed by the government when a property changes hands. There are two main types of land transfer taxes in Canada – the provincial land transfer tax and the municipal land transfer tax.

| Provincial Land Transfer Tax | Municipal Land Transfer Tax |

|---|---|

| Imposed by the provincial government | Imposed by the municipality |

| Rate and calculation method vary by province | Levied on the property’s sale price |

| Applies to properties in all provinces except Alberta and Saskatchewan | Applies only in certain municipalities, including Toronto and Montreal |

| Eligible for a first-time homebuyer rebate in some provinces | May have different rates and rebate options compared to the provincial tax |

| Subject to specific eligibility criteria for rebates or exemptions | Considered in addition to the provincial tax in certain areas |

Provincial Land Transfer Tax

The provincial land transfer tax is a tax that is imposed by the provincial government when the property changes hands. The rate and calculation method for this tax vary by province. In some provinces, first-time homebuyers may be eligible for a rebate, so it is essential to check the specific eligibility criteria for the rebate or exemption in your province. In Alberta and Saskatchewan, there is no provincial land transfer tax.

Municipal Land Transfer Tax

The municipal land transfer tax is an additional tax that is levied by the municipality when a property is sold. This tax is in addition to the provincial land transfer tax and is imposed in certain municipalities, such as Toronto and Montreal. The rate and rebate options for the municipal tax may differ from the provincial tax, so it is essential to be aware of the specific details for the area where the property is located.

Tips for First Time Home Buyers

Clearly, as a first time home buyer, you want to make sure you are prepared for all the costs associated with purchasing a home. Here are some tips to help you navigate the process:

- Research potential rebates and exemptions available to you as a first time home buyer.

- Get pre-approved for a mortgage to give you a clear understanding of what you can afford.

- Consider all the costs associated with buying a home, including land transfer tax, legal fees, and moving expenses.

- Work with a real estate agent who has experience working with first time home buyers and can guide you through the process.

Any assistance you can get in understanding the costs and requirements for first time home buyers will benefit you in the long run.

Researching Rebates and Exemptions

When you are a first time home buyer, it is important to thoroughly research the potential rebates and exemptions available to you. In some cases, government programs offer refunds or rebates on land transfer taxes for first time home buyers. Make sure to check with your local government or professional advisor to determine if you qualify for any of these benefits.

Budgeting for Land Transfer Taxes

As a first time home buyer, it is crucial to budget for all the costs associated with purchasing a home, including land transfer taxes. These taxes can vary depending on the purchase price of the home and the location. Make sure to factor in these costs when planning for your purchase.

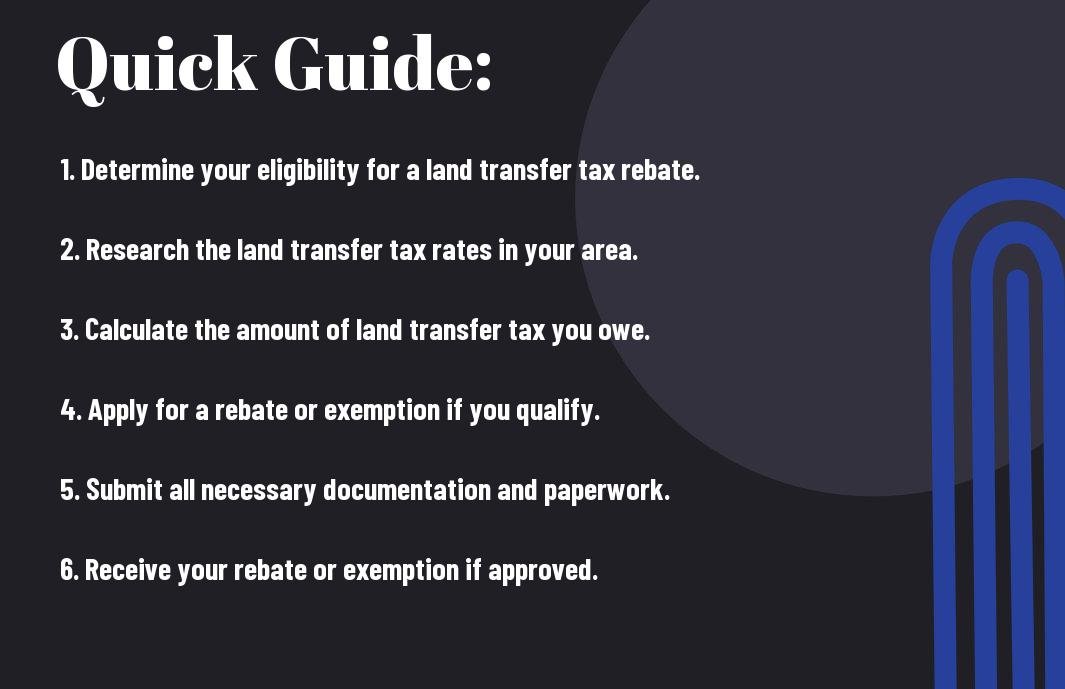

Step-by-Step Guide to Qualifying for a Rebate or Exemption

Your eligibility for a land transfer tax rebate or exemption will depend on factors such as your status as a first time home buyer, the purchase price of the property, and whether the property will be your primary residence. Below is a step-by-step guide to help you understand how to qualify for a rebate or exemption.

| Determining Eligibility Criteria | Applying for a Rebate or Exemption |

Determining Eligibility Criteria

Before applying for a land transfer tax rebate or exemption, it is essential to determine whether you meet the eligibility criteria. As a first time home buyer, you may be eligible for a full or partial rebate of the land transfer tax. To qualify, you must intend to occupy the home as your principal residence within 9 months of the purchase. Additionally, you must not have owned a home or had any interest in a home, anywhere in the world, at any time. Meeting these criteria is crucial in determining your eligibility for the rebate or exemption.

Applying for a Rebate or Exemption

Once you have determined your eligibility, the next step is to apply for the land transfer tax rebate or exemption. The application process typically involves completing the appropriate forms and providing supporting documentation, such as a copy of the registered transfer of the property. It is essential to ensure that all required documents are submitted accurately and on time to avoid any delays or complications in the application process. Taking the necessary steps to apply for the rebate or exemption is vital in maximizing the benefits available to you as a first time home buyer.

Factors to Consider Before Paying Land Transfer Tax

Despite being a mandatory expense for first time home buyers, there are a few factors to consider before paying land transfer tax, which can significantly impact the amount you will owe. Here are some key factors to keep in mind:

- Property Value: The cost of the property being purchased directly impacts the amount of land transfer tax owed. The higher the property value, the more tax you will be required to pay.

- Location of the Property: The location of the property also plays a significant role in determining the amount of land transfer tax payable. Properties located in urban areas or those with high property values typically have higher tax rates.

Though these factors may seem daunting, understanding them will help you calculate and prepare for the land transfer tax owed when purchasing your first home.

Property Value

The cost of the property being purchased directly impacts the amount of land transfer tax owed. The higher the property value, the more tax you will be required to pay. It’s important to take this into account when budgeting for your first home purchase. Higher property values can result in substantially larger tax amounts, so it’s crucial to factor this into your overall expenses.

Location of the Property

The location of the property also plays a significant role in determining the amount of land transfer tax payable. Properties located in urban areas or those with high property values typically have higher tax rates. You should research the tax rates in the specific location where you are considering purchasing a home to have a clear understanding of how it will impact your overall expenses.

Pros and Cons of Paying Land Transfer Tax as a First Time Home Buyer

For first time home buyers, paying the land transfer tax can be both a burden and an opportunity. Let’s take a look at the pros and cons of this obligation.

| Pros | Cons |

| 1. You can become a homeowner and start building equity. | 1. It can be a significant upfront cost, adding to the financial burden of buying a home. |

| 2. It’s a one-time payment and is usually a small percentage of the property’s value. | 2. It may impact your ability to afford other expenses related to moving or furnishing your new home. |

| 3. Depending on the property value, the tax amount may not be excessively high. | 3. It may limit your options when it comes to choosing a more expensive property. |

| 4. Paying the tax establishes you as a responsible homeowner willing to contribute to the community. | 4. It can add stress to an already complex home-buying process. |

Benefits of Rebates and Exemptions

As a first time home buyer, qualifying for rebates or exemptions can bring significant financial relief. These incentives are designed to lighten the financial burden and make home ownership more accessible. They can save you a substantial amount of money, allowing you to allocate your resources towards other important expenses related to your new home.

Drawbacks of Not Qualifying for Rebates or Exemptions

If you fail to qualify for rebates or exemptions, you may find yourself facing a significantly higher upfront cost associated with purchasing your first home. This could potentially limit your financial capacity and impact your ability to comfortably settle into your new living space. It’s important to explore all avenues and ensure you are aware of the potential drawbacks of not qualifying for these incentives.

Do First Time Home Buyers Pay Land Transfer Tax? How to Qualify for a Rebate or Exemption

Considering all points, it is clear that first time home buyers may be eligible for a land transfer tax rebate or exemption in certain jurisdictions. It is important to understand the specific requirements and qualifications for this benefit, as they can vary depending on your location. By researching and familiarizing yourself with the regulations in your area, you can ensure that you are taking advantage of any available rebates or exemptions. By working with an experienced real estate agent or tax professional, you can navigate the process smoothly and minimize the financial burden associated with purchasing your first home.

FAQ

Q: Do first-time home buyers pay land transfer tax?

A: Yes, first-time home buyers are typically required to pay land transfer tax. However, some jurisdictions offer rebates or exemptions for qualifying first-time buyers.

Q: How can first-time home buyers qualify for a land transfer tax rebate?

A: Qualifications for a land transfer tax rebate vary by jurisdiction, but typically, first-time home buyers must meet eligibility criteria such as never having owned a home before and using the property as their principal residence within a certain timeframe.

Q: What documents are required to apply for a land transfer tax rebate?

A: Applicants for a land transfer tax rebate may need to provide documents such as a copy of the agreement of purchase and sale, a copy of the land transfer tax statement, and proof of residency to demonstrate eligibility.

Q: Are there income restrictions for qualifying for a land transfer tax rebate?

A: Income restrictions for land transfer tax rebates vary by jurisdiction. Some areas may impose income thresholds to qualify for rebates or exemptions, so it’s important to check with the local government or tax authority.

Q: When should first-time home buyers apply for a land transfer tax rebate?

A: It’s advisable to apply for a land transfer tax rebate as soon as possible after completing the purchase of a new home to ensure that all necessary documentation is submitted within the required timeframe. Delays in applying for the rebate could result in missed opportunities for financial relief.

- Share

Mark Twain

Mark Twain stands at the helm of Create More Flow, infusing every sentence with the wisdom of his 15-year expeience through the seas of SEO and content creation. A former BBC Writer, Mark has a knack for weaving simplicity and clarity into a tapestry of engaging narratives. In the realm of content, he is both a guardian and a guide, helping words find their flow and stories find their homes in the hearts of readers. Mark's approach is grounded in the belief that the best content feels like a chat with an old friend: warm, inviting, and always memorable. Let Mark's expertise light up your website with content that's as friendly to Google as it is to your audience. Each word is chosen with care, each sentence crafted with skill - all to give your message the human touch that both readers and search engines love.