Are Weekends Considered Business Days – Navigating Timeframes in Commercial Transactions

- Home

- Are Weekends Considered Business Days – Navigating Timeframes in Commercial Transactions

Are Weekends Considered Business Days – Navigating Timeframes in Commercial Transactions

As a seasoned professional in the world of commercial transactions, I understand the importance of navigating timeframes and ensuring that deadlines are met. One of the most common questions that arise is whether weekends are considered business days, and the answer is not as straightforward as one might think. In this guide, I will provide you with a clear understanding of how timeframes are calculated in commercial transactions, highlighting the potential pitfalls and best practices to ensure that you are always ahead of the game. Whether you are a buyer, seller, or intermediary, understanding the nuances of timeframes can make or break a deal, and I am here to guide you through it.

Key Takeaways:

- Legal Definitions: When it comes to commercial transactions, weekends are generally not considered business days unless explicitly specified in the contract.

- Clarity in Contract Language: It’s crucial to clearly define what constitutes a business day within the contract to avoid any confusion or disputes.

- Impact on Timeframes: Understanding how weekends are treated in business days can be crucial in accurately calculating deadlines and timeframes for commercial transactions.

- Communication is Key: Clearly communicating and aligning expectations with all parties involved in the transaction regarding the treatment of weekends can help avoid misunderstandings and potential delays.

- Consult Legal Experts: When in doubt, seeking advice from legal professionals experienced in commercial transactions can provide valuable guidance on navigating timeframes and business day definitions.

Types of Timeframes in Commercial Transactions

The concept of timeframes in commercial transactions is crucial to understanding the obligations and responsibilities of all parties involved. There are two primary types of timeframes that are commonly used in commercial transactions: business days and calendar days. It is essential to understand the differences between these two types of timeframes to ensure that all parties are in agreement and to avoid any potential disputes or misunderstandings.

| Business Days | Only days on which banks are open for business, and it typically excludes weekends and public holidays. |

| Calendar Days | Includes all days, including weekends and public holidays. |

Business Days

In commercial transactions, business days are typically used to calculate deadlines and timeframes. This means that only the days on which banks are open for business are counted, and weekends and public holidays are excluded from the calculation. When I am negotiating a commercial contract, I always pay close attention to the definition of business days to ensure that I am aware of the precise timeframe for performance or delivery. It is crucial to understand the implications of business days to avoid any delays or misunderstandings in the transaction. Recognizing the importance of business days is vital to the successful and efficient execution of commercial transactions.

Calendar Days

On the other hand, calendar days include all days, including weekends and public holidays. This type of timeframe is commonly used in the legal context for statutory deadlines and time limitations. When calculating calendar days, it is important to consider weekends and public holidays, as they will affect the final deadline. I always make sure to clarify which type of timeframe is being used in a commercial transaction to avoid any confusion or disputes regarding the timeline. Understanding the differences between business days and calendar days is essential to effectively navigating timeframes in commercial transactions.

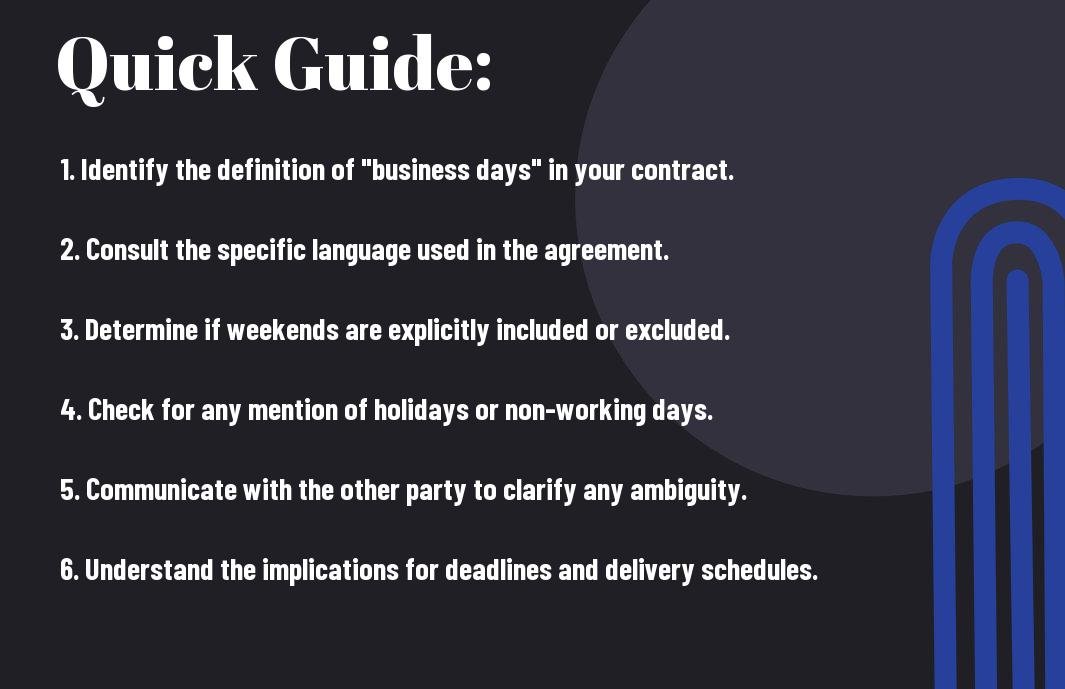

Tips for Navigating Timeframes

Clearly, understanding timeframes is crucial in commercial transactions. When navigating business days and contract terms, it’s important to keep a few key tips in mind to ensure smooth and successful transactions. Here are some tips to help you navigate timeframes effectively:

- Plan Ahead: When entering into a commercial transaction, it’s crucial to plan ahead and account for potential delays. Consider all relevant timeframes and set realistic milestones to keep the process on track.

- Understand Contract Terms: Review and understand the contract terms related to timeframes, including deadlines for deliverables, payment schedules, and dispute resolution processes. Clear understanding of these terms is essential for managing timeframes effectively.

- Communicate Proactively: Effective communication with all parties involved in the transaction can help to avoid misunderstandings and delays. Keep all stakeholders informed about relevant timeframes and any potential obstacles that may arise.

Perceiving potential challenges and staying proactive can help you navigate timeframes more effectively and ensure successful commercial transactions.

Planning Ahead

When it comes to navigating timeframes in commercial transactions, planning ahead is essential. Proper planning allows you to anticipate potential delays and obstacles, and set realistic timelines for completing various stages of the transaction. By setting clear milestones and deadlines, you can ensure that the process stays on track and any issues can be addressed proactively.

Understanding Contract Terms

Understanding the contract terms related to timeframes is crucial for managing commercial transactions effectively. Reviewing and comprehending the deadlines, milestones, and dispute resolution processes outlined in the contract can help you navigate timeframes more successfully. Clear understanding of these terms also allows you to anticipate potential issues and plan accordingly.

Step-by-Step Guide to Calculating Timeframes

After years of experience in commercial transactions, I have come to learn that calculating timeframes is a critical aspect that can make or break a deal. To help you navigate this process with confidence, I have put together a step-by-step guide to calculating timeframes that will ensure you stay on top of your business game.

Identifying the Start Date

When it comes to calculating timeframes in commercial transactions, the first step is to identify the start date. This is the date from which the timeframe will be measured, and it is crucial to pinpoint this accurately to avoid any discrepancies or misunderstandings later on. Whether it’s the date of a signed contract, the date of receipt of a notice, or any other specific event, being clear about the start date is essential for the accuracy of your calculations.

Factoring in Holidays and Weekends

One of the key factors that often trips people up when calculating timeframes is the treatment of holidays and weekends. Depending on the jurisdiction and the terms of your agreement, these non-business days may or may not be included in the calculation. It’s important to have a clear understanding of how these days will be treated in your specific situation, as this can have a significant impact on the overall timeframe of your transaction. Failure to properly account for holidays and weekends can result in missed deadlines and potential legal issues, so it’s essential to get this right from the start.

Factors to Consider in Timeframe Negotiations

Not all commercial transactions are the same, and there are several factors that need to be considered when negotiating timeframes. Here are some key points to keep in mind:

- Urgency: How quickly do you need the transaction to be completed? Is there a deadline that needs to be met?

- Complexity: How complicated is the transaction? Will it require extra time for due diligence or other checks?

- Availability: Are all parties involved available to move forward within a certain timeframe, or are there restrictions that need to be considered?

After considering these factors, it’s important to communicate your requirements clearly with all parties involved to ensure mutual understanding and agreement on the timeframe.

Legal Implications

When it comes to timeframes in commercial transactions, there may be legal implications to consider. It’s important to ensure that the timeline aligns with any legal obligations or requirements set forth by regulatory bodies or contracts. Failure to do so could result in legal consequences, so be sure to consult with a legal professional to ensure compliance.

Industry Norms

Understanding industry norms is crucial when negotiating timeframes in commercial transactions. Each industry may have its own standard practices and expectations when it comes to timeframes. By being aware of these norms, you can better align your expectations with industry standards and avoid potential misunderstandings with the other party.

Pros and Cons of Including Weekends in Business Days

Your decision on whether to include weekends in your definition of business days can have a significant impact on the timelines of your commercial transactions. Let’s take a closer look at the potential advantages and disadvantages of including weekends in your business days calculation.

Pros

When considering the inclusion of weekends in business days, there are several potential advantages to take into account. These include:

| Improved Efficiency | By including weekends as business days, you may be able to expedite the completion of certain transactions, leading to improved efficiency in your business operations. |

| Increased Flexibility | With weekends included, you may have greater flexibility in scheduling and completing tasks, providing more options for meeting deadlines. |

| Adaptability to Global Operations | If your business operates on a global scale, including weekends as business days can better align with the working hours of international partners and clients, facilitating smoother communication and transactions. |

Cons

Despite the potential advantages, there are also drawbacks to consider when including weekends in your business days calculation. These may include:

| Potential Burnout | With extended work weeks that include weekends, there is a risk of increased fatigue and potential burnout among employees and stakeholders. |

| Impact on Work-Life Balance | Extending business days to include weekends can disrupt the traditional work-life balance, leading to decreased satisfaction and morale among individuals within the organization. |

| Limited Availability of External Resources | External resources such as legal counsel, financial institutions, and regulatory bodies may have reduced availability on weekends, potentially delaying or complicating certain transactions. |

It’s important to carefully weigh the pros and cons of including weekends in your definition of business days, considering the specific needs and circumstances of your business. I have found that striking the right balance between efficiency and well-being is crucial in making this decision.

Are Weekends Considered Business Days – Navigating Timeframes in Commercial Transactions

Conclusively, it is clear that when it comes to commercial transactions, weekends are not considered business days. It is important to be aware of this distinction when navigating timeframes in such transactions. Understanding the implications of excluding weekends from business days can prevent delays and ensure that deadlines are met. By keeping this in mind, you can effectively plan and manage your commercial transactions with confidence and precision.

FAQ: Are Weekends Considered Business Days – Navigating Timeframes in Commercial Transactions

Q: Are weekends considered business days in commercial transactions?

A: No, weekends are not considered business days in commercial transactions. Business days typically refer to Monday through Friday, excluding weekends and public holidays.

Q: Why are weekends not considered business days?

A: Weekends are not considered business days because most businesses and financial institutions are closed during the weekend. Therefore, transactions cannot be processed or completed during this time.

Q: Can commercial transactions be conducted on weekends?

A: While some businesses may operate on weekends, the processing and completion of commercial transactions are generally not conducted on weekends. It is important to check the specific operating hours of the entities involved in the transaction.

Q: Are there any exceptions to weekends not being considered business days in commercial transactions?

A: In some cases, specific agreements or contracts may define business days to include weekends, especially in industries where weekend operations are common. However, this would need to be explicitly stated in the terms of the agreement.

Q: How do I navigate timeframes in commercial transactions considering weekends and public holidays?

A: When navigating timeframes in commercial transactions, it is important to account for weekends and public holidays by excluding them from the calculation. It is also crucial to communicate with all involved parties to ensure that timing expectations are aligned and realistic.

- Share

Mark Twain

Mark Twain stands at the helm of Create More Flow, infusing every sentence with the wisdom of his 15-year expeience through the seas of SEO and content creation. A former BBC Writer, Mark has a knack for weaving simplicity and clarity into a tapestry of engaging narratives. In the realm of content, he is both a guardian and a guide, helping words find their flow and stories find their homes in the hearts of readers. Mark's approach is grounded in the belief that the best content feels like a chat with an old friend: warm, inviting, and always memorable. Let Mark's expertise light up your website with content that's as friendly to Google as it is to your audience. Each word is chosen with care, each sentence crafted with skill - all to give your message the human touch that both readers and search engines love.