How Does a Portable Mortgage Work? The Advantages and Disadvantages of Moving Your Mortgage

- Home

- How Does a Portable Mortgage Work? The Advantages and Disadvantages of Moving Your Mortgage

How Does a Portable Mortgage Work? The Advantages and Disadvantages of Moving Your Mortgage

As a homeowner, porting your mortgage can be an attractive option when it comes to moving. It allows you to transfer your existing mortgage to a new property, saving you from paying hefty penalties for breaking your current mortgage contract. In this guide, I will explain how a portable mortgage works, and the advantages and disadvantages of choosing this option. Understanding the ins and outs of a portable mortgage can help you make an informed decision when it comes to your financial future.

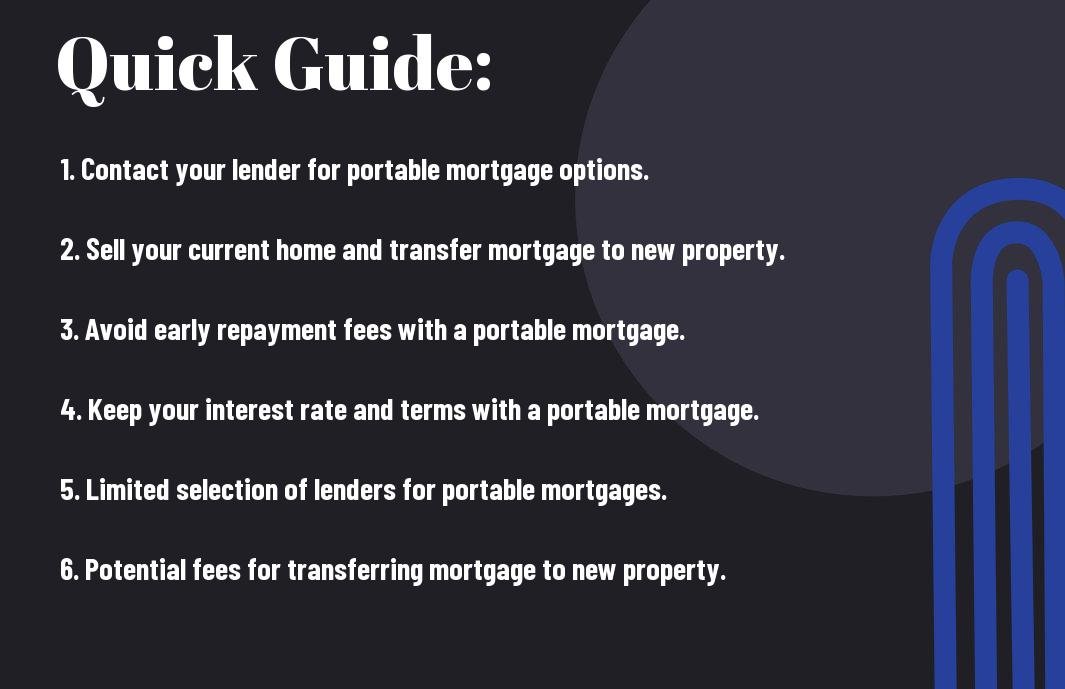

Key Takeaways:

- Portability of mortgage: A portable mortgage allows you to transfer your existing mortgage to a new property when you move, without having to pay a penalty for breaking the mortgage.

- Advantages: Porting your mortgage can save you money on penalties and fees, and it allows you to keep your existing interest rate and terms, which can be beneficial if rates have increased since you obtained your mortgage.

- Disadvantages: There may be limitations on the properties you can transfer your mortgage to, and the process can be complex and time-consuming. Additionally, you may not be able to access the same mortgage products and rates available for new mortgages.

- Considerations: Before deciding to port your mortgage, carefully review the terms and conditions of your existing mortgage, as well as the potential costs and limitations of transferring it to a new property.

- Consultation: It’s important to seek advice from a mortgage advisor or financial professional to determine if porting your mortgage is the best option for your specific situation.

Types of Portable Mortgages

A portable mortgage comes in a few different forms, each with its own advantages and disadvantages. Here are the main types:

- Fixed-rate mortgages: These mortgages offer a consistent interest rate for the entire duration of the loan. They are a popular option for those seeking stability and predictability in their mortgage payments.

- Adjustable-rate mortgages: These mortgages have an interest rate that can fluctuate over time, often based on an index. They may start with a lower initial rate, but can increase over time.

Though they may seem similar, these two types of mortgages have distinct features and implications that can significantly affect your financial situation.

Fixed-rate mortgages

A fixed-rate mortgage is a popular choice for those who want the security of knowing exactly what their monthly payments will be for the entire term of their mortgage. With a fixed-rate mortgage, the interest rate remains the same, which means your monthly payments will not change. This predictability can provide peace of mind and make budgeting easier. However, the downside is that if interest rates decrease, you will be locked into a higher rate unless you refinance your mortgage.

Adjustable-rate mortgages

Adjustable-rate mortgages (ARMs) typically offer a lower initial interest rate compared to fixed-rate mortgages. This can make them an attractive option for individuals who plan to move within a few years. However, ARMs come with the risk of the interest rate rising over time, potentially leading to higher monthly payments. It’s essential to carefully consider your financial stability and your long-term plans before choosing an ARM, as the fluctuating interest rates can make budgeting more challenging.

Tips for Moving Your Mortgage

The process of moving your mortgage to a new lender can be quite overwhelming. However, with proper planning and consideration, it can be a rewarding decision. Here are some tips to help you navigate the process smoothly:

- Research different lenders and their offers

- Consider fees and penalties

- Assess your financial situation

- Seek professional advice

This will ensure that you make the right choice and avoid any potential pitfalls.

Researching lenders

When considering moving your mortgage, it is essential to research different lenders and their offers. Look for competitive interest rates and favorable loan terms. You should also consider the reputation and customer service of the lender. This will help you make an informed decision and find a lender that best suits your needs.

Considering fees and penalties

Moving your mortgage may come with fees and penalties, such as early repayment charges or exit fees. It is important to carefully assess these costs and consider whether the savings from moving your mortgage outweigh these expenses. Additionally, consider any potential fees associated with setting up a new mortgage with a different lender. This will help you avoid any surprises and make a well-informed decision.

Step-by-Step Process for Moving Your Mortgage

For those considering moving their mortgage, it’s important to understand the step-by-step process involved. Below is a breakdown of the key steps involved in moving your mortgage to a new lender.

| Step | Description |

|---|---|

| 1. Researching new lenders | Begin by researching new lenders and comparing their mortgage products and rates to find the best option for your needs. |

| 2. Notifying your current lender | Once you’ve chosen a new lender, you’ll need to notify your current lender of your intention to move your mortgage. |

| 3. Applying for a new mortgage | Next, you’ll need to apply for a new mortgage with the chosen lender, providing all necessary documentation and information. |

| 4. Closing your current mortgage | After approval for the new mortgage, you’ll close your current mortgage with your existing lender, paying off the remaining balance. |

| 5. Finalizing the new mortgage | Finally, you’ll finalize the new mortgage with your chosen lender, completing all necessary paperwork and arrangements. |

Notifying your current lender

When it comes to moving your mortgage, notifying your current lender is a crucial first step. It’s important to understand the terms of your existing mortgage, including whether there are any penalties or fees for paying off the mortgage early. I advise reaching out to your lender directly to discuss your intentions and to gather all necessary information about the process.

Applying for a new mortgage

Once you’ve made the decision to move your mortgage, applying for a new mortgage with a different lender is the next step. You’ll need to provide comprehensive documentation, including proof of income, employment history, and credit history. It’s essential to carefully review the terms and conditions of the new mortgage, including interest rates, fees, and any potential penalties for early repayment. I highly recommend working with a reputable mortgage advisor to guide you through this process and ensure you’re making the best decision for your financial situation.

Factors to Consider When Deciding to Move Your Mortgage

Your mortgage is likely the biggest financial commitment you will make in your lifetime, so it’s important to weigh your options carefully before deciding to move it. There are several factors to consider when determining whether it’s the right move for you. Here are some key considerations to keep in mind:

- Interest rates: Before making the decision to move your mortgage, it’s crucial to understand the current interest rates and how they compare to the rate you currently have on your mortgage.

- Length of time in current home: The amount of time you have left in your current home can also play a significant role in whether it makes sense to move your mortgage.

The more information you have about these and other relevant factors, the better equipped you will be to make an informed decision about whether moving your mortgage is the right move for you.

Interest rates

When considering whether to move your mortgage, one of the most important factors to take into account is the current interest rates. I have the potential to provide substantial savings over the life of your loan.

Length of time in current home

The length of time you plan to stay in your current home is a crucial consideration when deciding whether to move your mortgage. If you foresee a move in the near future, it may not make sense to go through the process of moving your mortgage.

Pros and Cons of a Portable Mortgage

Unlike a traditional mortgage, a portable mortgage offers the advantage of being able to transfer your existing mortgage to a new property without penalty. However, there are also disadvantages to consider when deciding whether to opt for a portable mortgage. Let’s take a closer look at the pros and cons:

Advantages

One of the primary advantages of a portable mortgage is the flexibility it offers. If you decide to move to a new property, you can simply transfer your existing mortgage without having to pay hefty penalties for breaking the mortgage agreement. This can save you significant costs and hassle, especially if you are in the middle of a mortgage term. Additionally, a portable mortgage eliminates the need to reapply for a new mortgage, saving you time and paperwork.

Disadvantages

While a portable mortgage offers flexibility, it may come with limitations. For example, not all lenders offer portable mortgages, so you may be limited in your options when it comes to transferring your mortgage to a new property. Additionally, if the new property is more expensive, you may have to make up the difference in financing, which could result in higher monthly payments. Furthermore, if you are unable to sell your current home, you may still be on the hook for maintaining both properties and paying two mortgages.

To wrap up

Now that we have explored how a portable mortgage works and the advantages and disadvantages of moving your mortgage, it is important to carefully consider your specific financial situation before making a decision. If you are someone who anticipates moving in the near future, a portable mortgage can provide flexibility and save you money on penalty fees. However, it’s crucial to weigh the potential downsides, such as limited options and potential fees, before making a commitment. Ultimately, I encourage you to consult with a financial advisor and your mortgage lender to determine the best course of action for your individual circumstances.

FAQ

Q: What is a portable mortgage?

A: A portable mortgage allows you to transfer your existing mortgage from one property to another without having to pay penalties or go through the loan application process again.

Q: How does a portable mortgage work?

A: When you sell your current home and buy a new one, you can transfer your existing mortgage to the new property. The terms of the mortgage, including the interest rate and loan amount, remain the same. You simply complete the necessary paperwork with your lender to make the transfer.

Q: What are the advantages of a portable mortgage?

A: One advantage of a portable mortgage is that it allows you to avoid early repayment charges that may apply if you were to break your mortgage and take out a new one. Additionally, you can maintain the same interest rate and terms, which can be beneficial if rates have increased since you first obtained your mortgage.

Q: What are the disadvantages of a portable mortgage?

A: The main disadvantage of a portable mortgage is that it may not be available from all lenders, or it may only be offered on certain mortgage products. There may also be restrictions on the properties to which you can transfer the mortgage, and your lender will need to approve the new property before the transfer can take place.

Q: Are there any costs associated with transferring a portable mortgage?

A: While there may not be a penalty for transferring a portable mortgage, there can still be administrative fees and legal costs associated with the transfer process. It’s important to discuss these potential costs with your lender before deciding to move your mortgage to a new property.

- Share

Mark Twain

Mark Twain stands at the helm of Create More Flow, infusing every sentence with the wisdom of his 15-year expeience through the seas of SEO and content creation. A former BBC Writer, Mark has a knack for weaving simplicity and clarity into a tapestry of engaging narratives. In the realm of content, he is both a guardian and a guide, helping words find their flow and stories find their homes in the hearts of readers. Mark's approach is grounded in the belief that the best content feels like a chat with an old friend: warm, inviting, and always memorable. Let Mark's expertise light up your website with content that's as friendly to Google as it is to your audience. Each word is chosen with care, each sentence crafted with skill - all to give your message the human touch that both readers and search engines love.