Why Do Realtors Prefer Local Lenders – The Advantage of Regional Mortgage Providers

- Home

- Why Do Realtors Prefer Local Lenders – The Advantage of Regional Mortgage Providers

Why Do Realtors Prefer Local Lenders – The Advantage of Regional Mortgage Providers

As a seasoned real estate professional, I have witnessed firsthand the significant advantages of working with local lenders when it comes to securing financing for your clients. In an industry where time is of the essence, having a regional mortgage provider on your side can make all the difference in closing a deal smoothly and efficiently. There are several reasons why realtors prefer local lenders over big national banks, and in this guide, I will delve into the key benefits that come with choosing a regional mortgage provider for your clients’ financing needs. From personalized service to in-depth knowledge of the local market, working with a local lender can give you a significant competitive edge in the real estate industry.

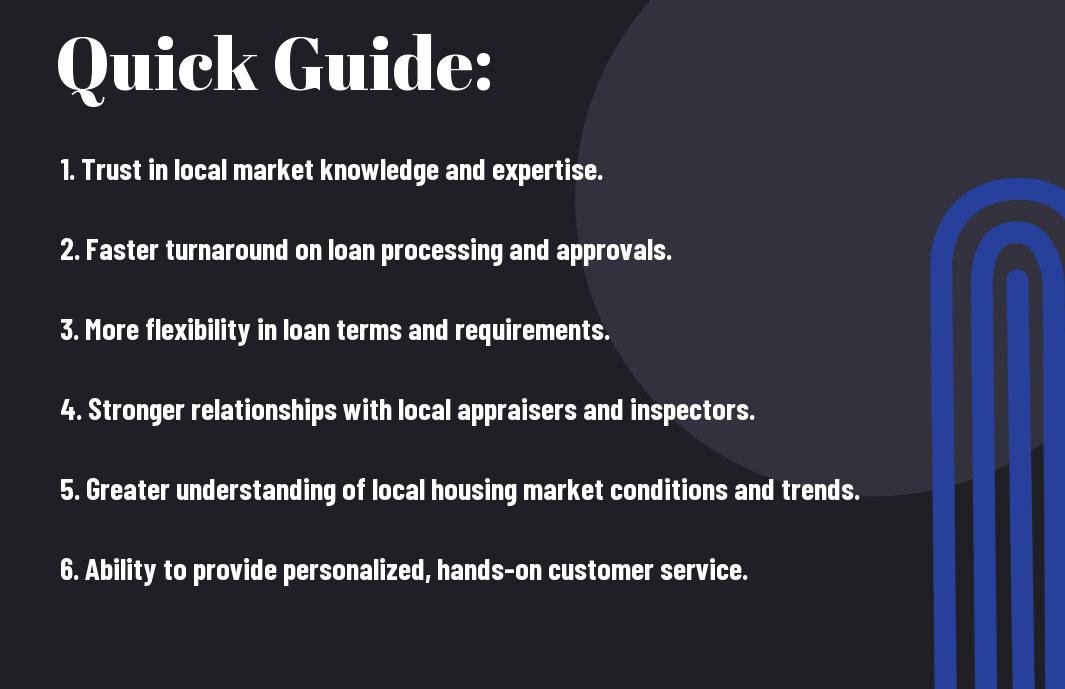

Key Takeaways:

- Understanding of local market: Local lenders have a deep understanding of the local market and can provide valuable insights for both the realtor and the homebuyer.

- Personalized service: Regional mortgage providers offer a more personalized service, allowing realtors to build strong working relationships and provide a better overall experience for their clients.

- Faster processing times: Local lenders often have quicker processing times, which can be crucial in competitive real estate markets.

- Flexibility in loan options: Regional mortgage providers may offer more flexibility in loan options and criteria, allowing realtors to better match their clients with the right mortgage product.

- Local reputation and reliability: Working with a local lender can provide a sense of reliability and trust, as they are often well-established and have a good reputation within the community.

Types of Lenders

For homebuyers, there are primarily two types of lenders to consider when securing a mortgage: local lenders and national lenders. Each has its own set of advantages and disadvantages, and it’s important to understand the differences before making a decision on which to use for your home purchase. This information is key to finding the right mortgage provider for your needs.

| Local Lenders | National Lenders |

| Personalized service | Wide variety of loan options |

| Deep knowledge of local market | Strong online presence |

| Faster processing times | May offer lower interest rates |

| Flexibility in lending criteria | May have stricter requirements |

| Ability to build long-term relationships | Brand recognition and reputation |

Local Lenders

When it comes to securing a mortgage, working with a local lender can provide a number of advantages. Local lenders typically offer personalized service tailored to your specific needs and situation. They also have a deep understanding of the local market, allowing them to provide valuable insights and guidance throughout the process. Additionally, local lenders often have faster processing times and may be more flexible in their lending criteria, making it easier for you to secure the financing you need for your home purchase.

National Lenders

On the other hand, national lenders may offer a wide variety of loan options and may have a strong online presence, making it convenient to manage your mortgage digitally. They may also have the advantage of offering potentially lower interest rates due to their larger scale and broader reach. However, it’s important to note that national lenders may have stricter requirements and may not have the same level of local market knowledge as local lenders. This can impact the level of personalized service and tailored guidance you receive throughout the mortgage process.

Tips for Choosing a Local Lender

Obviously, choosing the right local lender can make all the difference when it comes to securing the best mortgage for your real estate purchase. Here are some tips for selecting the best lender for your needs:

- Do your research and shop around for the best rates and terms.

- Ask for recommendations from local realtors and other homebuyers.

- Consider the lender’s reputation and experience in the local market.

- Look for a lender with a strong understanding of the local real estate market.

- Seek out a lender that can provide personalized service tailored to your specific needs.

Recognizing the importance of these factors will help you make an informed decision when choosing a local lender.

Reputation and Experience

When choosing a local lender, it’s crucial to consider their reputation and experience in the real estate market. An established lender with a solid track record can provide you with greater confidence and peace of mind throughout the mortgage process. Make sure to read reviews, ask for referrals, and do your due diligence to ensure you’re working with a reputable and experienced local lender.

Understanding of Local Market

Another key factor to consider when choosing a local lender is their understanding of the local market. A lender with extensive knowledge of the neighborhoods and real estate trends in your area can offer valuable insights and guidance as you navigate the homebuying process. This local expertise can be incredibly beneficial when it comes to finding the right loan for your specific property and financial situation.

Personalized Service

One of the major advantages of working with a local lender is the personalized service they can provide. Unlike larger national banks, local lenders often offer a more hands-on and tailored approach to customer service. This means they can take the time to understand your individual needs and provide customized solutions that align with your homebuying goals. When navigating the complex mortgage process, the personal touch of a local lender can make all the difference.

Step-by-Step Guide to Working with a Local Lender

Keep in mind that when working with a local lender, the process will typically be more personalized and hands-on compared to working with a large, national lender. Here is a step-by-step guide to working with a local lender:

| Step | Description |

| 1. Prequalification Process | I’ll walk you through the prequalification process, which involves providing basic information about your finances to determine how much you can borrow. |

| 2. Loan Application | Once you find a home you want to purchase, you’ll complete a loan application with me, and I’ll assist you every step of the way. |

| 3. Loan Approval and Closing | After your loan is approved, I’ll work closely with you and the title company to ensure a smooth and timely closing process. |

Prequalification Process

During the prequalification process, I’ll gather information about your income, assets, and debts to assess your financial situation. This will help us determine the loan amount you may qualify for and the interest rate you may be eligible to receive. It’s important to be honest and thorough when providing this information, as it will ultimately impact the terms of your loan.

Loan Application

When you find a home you’re interested in purchasing, you’ll need to complete a loan application. I’ll guide you through the application process, helping you gather all the necessary documentation and ensuring that everything is submitted accurately and on time. This step is crucial in securing your financing, so I’ll be in close communication with you to address any questions or concerns that may arise.

Loan Approval and Closing

After your loan application is submitted, it will undergo a thorough review by the underwriting team. Once your loan is approved, we’ll move forward with the closing process. I’ll work with you and the title company to coordinate all necessary paperwork and ensure a seamless closing. This is the final step in the homebuying process, and I’ll be by your side to make sure everything goes smoothly.

Factors to Consider When Selecting a Mortgage Provider

Not all mortgage providers are created equal, and it’s important to carefully evaluate your options when selecting a lender for your home purchase. As a Realtor, I have seen firsthand the impact that the right mortgage provider can have on a real estate transaction. Here are some key factors to consider when making this important decision:

- Interest Rates: When comparing mortgage providers, be sure to pay close attention to the interest rates they offer. Even a slightly lower rate can translate to significant savings over the life of your loan. It’s also important to consider whether the lender offers a variety of loan options, as this can impact the rate you are able to secure.

- Customer Service: The level of customer service provided by a mortgage lender can make a big difference in your overall experience. Look for a provider who is responsive, communicative, and willing to go the extra mile to ensure your satisfaction.

- Flexibility of Loan Options: Another important factor to consider is the flexibility of loan options offered by the lender. A provider who offers a variety of loan programs and is willing to work with you to find the best fit for your needs can help make the mortgage process smoother and more tailored to your individual situation.

Knowing how to evaluate these key factors can help you make an informed decision when selecting a mortgage provider for your home purchase. I always advise my clients to carefully weigh these considerations and select a lender who aligns with their financial goals and preferences.

Interest Rates

When it comes to selecting a mortgage provider, one of the most important factors to consider is the interest rate they are able to offer you. Even a small difference in interest rates can have a significant impact on your monthly payments and the overall cost of your loan. Be sure to carefully compare rates from different lenders to ensure you are getting the best possible deal.

Customer Service

Another critical factor to consider when selecting a mortgage provider is the level of customer service they offer. A lender who is responsive, communicative, and easy to work with can make the entire mortgage process much smoother and less stressful. Look for a provider who is dedicated to providing excellent service and support throughout the loan application and approval process.

Flexibility of Loan Options

When evaluating mortgage providers, it’s important to consider the flexibility of loan options they offer. A lender who offers a variety of loan programs and is willing to tailor a loan to your specific needs can make a big difference in your overall experience. Whether you are a first-time homebuyer or a seasoned investor, having access to a range of loan options can help ensure that you find the best fit for your financial situation.

Pros and Cons of Using Regional Mortgage Providers

To effectively weigh the advantages and disadvantages of utilizing regional mortgage providers, I have compiled a list of pros and cons to consider. This will help you make an informed decision when choosing a mortgage lender for your home purchase.

Pros

When it comes to working with a regional mortgage provider, there are several advantages to consider. Firstly, regional lenders often have a more in-depth understanding of the local housing market. This means they can offer valuable insights and guidance specific to your area, helping you make the best mortgage decision for your needs. Additionally, regional lenders may have more flexible underwriting criteria, allowing for a more personalized approach to your mortgage application. Furthermore, working with a local lender can often lead to quicker loan processing times, as they are familiar with the local processes and can offer more streamlined services. Lastly, regional lenders may be more willing to negotiate terms and rates, providing you with a more personalized and favorable mortgage deal.

Cons

While there are numerous benefits to working with regional mortgage providers, there are also some potential drawbacks to consider. One of the main disadvantages is that a regional lender may have a more limited range of mortgage products compared to larger, national lenders. This could potentially limit your options when it comes to finding the best mortgage for your needs. Additionally, regional lenders may have fewer resources and technological advancements compared to larger institutions, which could result in a less efficient and modernized mortgage process. It is also important to note that regional lenders may have stricter geographic lending restrictions, limiting their ability to finance properties in certain areas. Lastly, regional lenders may have less competitive interest rates and fees compared to larger, national lenders, which could impact the overall cost of your mortgage.

Why Do Realtors Prefer Local Lenders – The Advantage of Regional Mortgage Providers

Drawing together all the points discussed, it is clear why local lenders are preferred by realtors. Working with a regional mortgage provider can offer several advantages, from deep knowledge of the local market to personalized service and faster loan processing. By partnering with a local lender, you can benefit from their expertise, connections, and commitment to your community, ultimately leading to a smoother and more successful home buying experience for you and your clients. It is no wonder why realtors value the convenience and reliability of regional mortgage providers in their business dealings.

FAQ

Q: Why do realtors prefer local lenders over national ones?

A: Realtors tend to prefer local lenders because they have a deep understanding of the local market and can provide personalized service tailored to the specific needs of their clients.

Q: What are the advantages of using a regional mortgage provider?

A: Regional mortgage providers have in-depth knowledge of the local market and are often able to offer more competitive rates and loan options compared to national lenders.

Q: How does using a local lender benefit the home buying process?

A: Local lenders can offer faster turnaround times, more flexibility, and better communication throughout the home buying process, making it smoother and more efficient for both the buyer and the realtor.

Q: What should homebuyers consider when choosing between a local and national lender?

A: Homebuyers should consider the level of personalized service, local market knowledge, and competitive rates offered by local lenders versus the convenience and brand recognition of national lenders when making their decision.

Q: How can realtors and homebuyers find reputable local lenders?

A: Realtors and homebuyers can find reputable local lenders by asking for referrals from other industry professionals, researching online reviews, and meeting with potential lenders to discuss their specific needs and services offered. It’s important to find a lender that aligns with the needs of the homebuyer and the realtor to ensure a successful home buying experience.

- Share

Mark Twain

Mark Twain stands at the helm of Create More Flow, infusing every sentence with the wisdom of his 15-year expeience through the seas of SEO and content creation. A former BBC Writer, Mark has a knack for weaving simplicity and clarity into a tapestry of engaging narratives. In the realm of content, he is both a guardian and a guide, helping words find their flow and stories find their homes in the hearts of readers. Mark's approach is grounded in the belief that the best content feels like a chat with an old friend: warm, inviting, and always memorable. Let Mark's expertise light up your website with content that's as friendly to Google as it is to your audience. Each word is chosen with care, each sentence crafted with skill - all to give your message the human touch that both readers and search engines love.